The process of refinancing a home does not lower your credit score very much. Your credit score will recover quickly from the loss caused by new credit. You will likely see your score rise within a few months. This is important, because most people care only about their credit score when they apply to mortgages.

Refinancing may lower your monthly mortgage payments

Refinancing mortgages can lower your monthly payments but it can also negatively affect credit. Before refinancing, make sure you understand how refinancing works. Although some may feel intimidated by the process it is actually simpler than applying to for a new loan. It can also be a wise financial decision, even if it means lowering your monthly mortgage payment.

Refinance a mortgage involves combining multiple loans to make one. This is advantageous for you as you only need one payment instead. The new interest rate is also lower. The lender may conduct a credit inquiry about your credit history when you refinance. This can temporarily lower your credit score. Your credit score will recover if you make your monthly payments on time and have a good payment history.

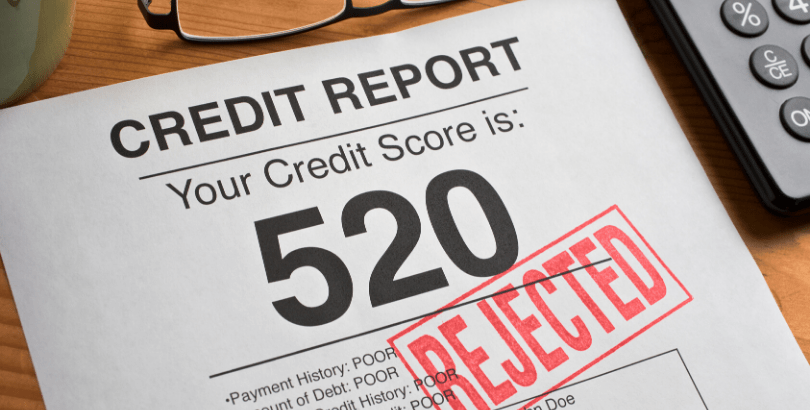

It can also lower your credit score

Refinancing comes with the risk that your credit score will be pulled by the new lender. This could cause your credit score drop. It is best to keep your existing mortgage current to avoid this. Refinancing to pay off a new mortgage should be avoided if possible. These can cause more negative credit reports and further drops in your credit score. It is also a bad idea to open new credit cards. This will increase your credit utilization ratio which can cause your score drop further.

Check your credit score before you refinance. Your credit score should not be lower than it was when the original loan was taken out. Be sure to consult several lenders and make sure to find a loan that fits your needs. Refinancing should not be done while you are opening new credit lines. This will lead to additional hard inquiries and could negatively impact your credit score.

It can also affect your credit history

Refinancing your home can affect your credit history in a couple of ways. First, you will have a new account added to your credit reports. This will have a negative impact on your credit history over the next year. The second is that it will lead to a hard inquiry on credit reports. The credit bureaus are allowed to report the hard inquiry for up two weeks. The impact of these hard inquiries will lessen over time, but you should still be mindful of how refinancing will impact your credit.

Luckily, refinancing can help you lower your debt and reduce your monthly payments. While credit scores may temporarily decline, they will recover within a few month. Refinancing involves taking out a new loan which will reduce your debt. You will see a decrease in your credit score. However, it will also reduce your interest rate.

It can increase your credit rating

Refinance of your mortgage is a process where you apply to several lenders. This is done so that you can get the lowest interest rates possible. Multiple applications can damage your credit score. Numerous applications may negatively impact your credit score.

There are some things you can do to avoid refinancing causing credit damage. Start by reviewing your credit history. You may have mistakes on your report that can lower your score. Refinancing may be possible if you prove to lenders that you make timely payments on current loans.

It can lead to higher debt payments

Debt consolidation is one way to reduce the amount of debt you have. This is a process that combines several small loans to create one large loan. The monthly payments are all the same. This can be done using low-interest credit card, personal loans or home equity loans. However, debt consolidation has some downsides.