It is important to keep your payments up in order to build credit history. This will make it easier for you to qualify for lower interest rates on balance transfer or unsecured credit cards, which you may need in a pinch. This will help you obtain favorable rates for car loans and mortgages. Having good credit will also help you get better car insurance rates, and some landlords will use your credit score to screen potential tenants.

Pay bills on time

Paying your bills on time is important if you want to avoid late fees. Late fees add up quickly, and it can be difficult to plan your monthly spending. These fees can spiral out of control and make it almost impossible to pay your next bill. There are several ways that you can make paying your bills promptly a habit.

To remind yourself when your bills due, set up an electronic calendar reminder. They should be set at least five days in advance of the due date. This will allow you to avoid missing payments because of time zone differences.

Keep balances low

One of the most effective ways to raise your credit score is to keep your balances low. Experts recommend that you have a credit limit of at least 30 percent. It's better to pay down debt than to transfer it into another account. By paying your bills each month, your credit score will improve by reducing your debt.

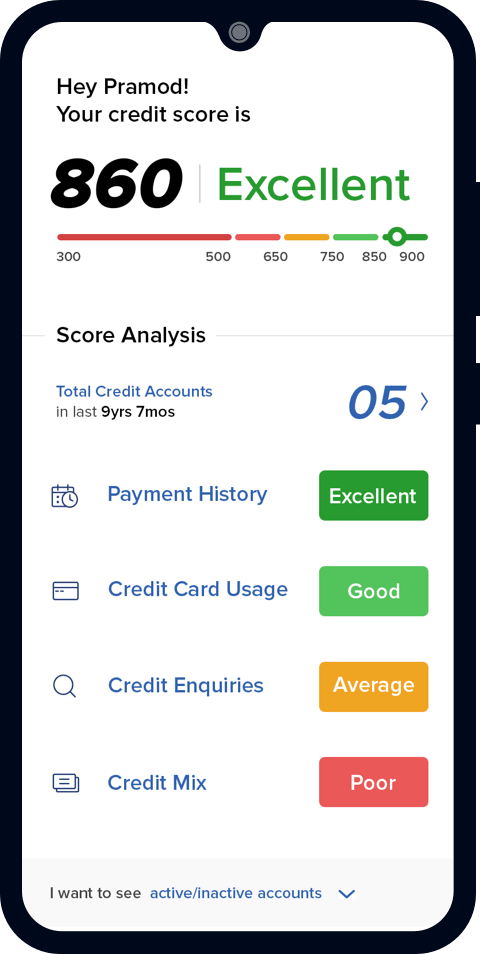

Your FICO(r), or credit utilization, accounts for around 30%. A credit utilization ratio of more than 30% indicates financial dependence. If your credit utilization is low, it means that you don’t rely on credit cards as your primary source for income.

A long credit history is important

Building a credit score is only possible if you have a long credit record. Your credit score is based on several factors, including your payment history and the amount you owe lenders. It is important to keep your credit utilization low and pay your bills on-time to build a solid credit history.

15% of your overall credit score depends on your credit history. You can increase your score by having accounts that have been active for at least two years. Pay off past due credit card balances. Having a long credit history will help you get a lower interest rate on loans and credit cards.

Lower utilization is better

Your credit utilization ratio should be low if you want to improve your credit score. It may seem difficult to keep your ratio below 30%, but there are several simple steps you can take. A lower utilization rate shows that you have better financial health overall. A lower utilization rate means that you can access credit when you are needed.

It is important to apply for credit cards with higher credit limits as the first step. The first step is to open a new account. This will increase your total credit limit, and lower your credit utilization. This step won't necessarily improve your credit score. Opening another account will only increase your total credit limit, which will negatively impact your score.