Many financial managers suggest that consumers review their credit reports every year. This is a free process. It is an excellent idea to do so each year. It is also a great idea to correct any errors made. This should be included on your "To Do” List. It is important that you know what areas are included in your report.

Payment history

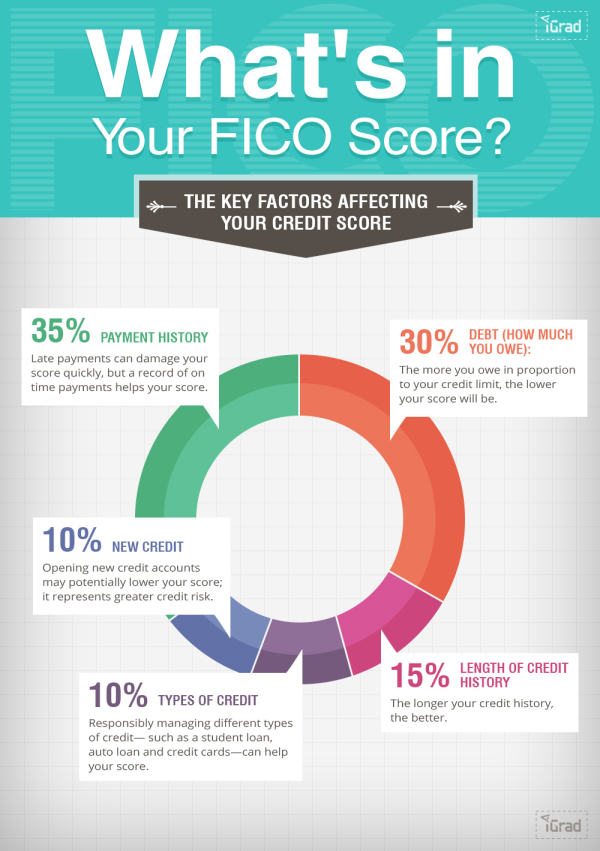

One of the most important pieces that make up a credit score is your payment history. This information shows late payments and their severity. Your score will be affected depending on how often and how severe your late payments were. Consumers who pay their bills on time generally have a positive payment record.

Your payment history will improve if you make your payments on-time. Although it may require some sacrifices, this is an essential step in building a positive payment record. Even if there are multiple accounts, it is important to ensure that your bills are paid on time each month. Using autopay or calendar reminders to remind yourself to pay your bills may be helpful. If you're having difficulty paying your bills, it may be time to review your spending habits.

Credit history length

The length of your credit history is one of the most important factors that affect your credit score. Your credit score will increase the longer you have had it. This is calculated using the average age for all your accounts. Older accounts show up on your report longer than new ones.

By adding up all your accounts, and dividing by the number year you have been using them, the length of credit history can be calculated. You can cut your history's average length by half by opening a new bank account. Also, opening a new account will result in a hard inquiry to your credit report. It is crucial to take into account this hard inquiry when applying for credit. It is possible to lower your score significantly by making a hard inquiry. You should act quickly to recover.

New credit

When you're applying for new credit it's important that you know the types and extent of any inquiries that may appear in your credit report. While it's possible to make several inquiries at one time, credit scoring mavens tend to count them as one if they are made within a certain time period, which can vary from fifteen to 45 days.

Types of credit

Credit files provide a detailed history about your borrowing habits. Consumer credit agencies (CRAs), keep separate files for each customer. Lenders and merchants use this information to evaluate your risk. Your credit score is based on the data from these files, which helps them decide how much you're risky to lend.

Age of the account

Your credit score can be affected by the age of your credit history. Your credit score will rise the longer you have had credit history. Account age is calculated by taking the average age of all your accounts, and dividing it by the number of accounts you have. A mix of old and newly opened accounts is important as it will help you show how you have managed different types debt. FICO or VantageScore can be used to calculate credit scores.

One of the most common mistakes people make is misinterpreting account age. Account age can be affected by many factors. You must also be aware of what each of these factors means for your credit score.