There are some things you should consider if you're wondering how long closed accounts stay on your credit reports. For instance, a closed credit account will generally remain on your credit report for seven to 10 years. This negative mark on your credit history will reduce your credit score and increase your credit utilization.

Closed since 7 to 10 years

It is easy to forget the fact that an account is closed on your credit reports. This information can cause credit problems. Credit card issuers often close accounts due to inactivity. Therefore, it's important to make timely payments if your credit account is to be maintained. If you don't make payments on time, delinquency can be a problem and will stay on your credit report for seven years.

You can request the removal of these closed accounts from your credit report. But, they aren't required to do this. If you have good credit and a long-term relationship with creditors, you can ask the bureaus for closed accounts to be removed. The account will be removed from your credit reports and it will fade over time. If accounts are in good standing, they will be reported as closed for 7-10 years. However, if an adverse credit history exists, they may remain on your credit file for longer.

Credit utilization rate increases

It is common to believe that closed accounts will increase your credit utilization. A common misconception behind this belief is that closed accounts don’t count towards credit age. In fact, a closed account does increase your credit utilization rate. This is because closed accounts still have debt, but they no longer act as a cushion.

Closing credit cards accounts has immediate consequences, but they can also have a long-lasting impact on your credit score. A high credit utilization rate can be a sign of trouble. It's better to have a lower credit utilization rate than to have more available credit. Additionally, higher credit utilization rates indicate greater risk to lenders.

Shortens credit history

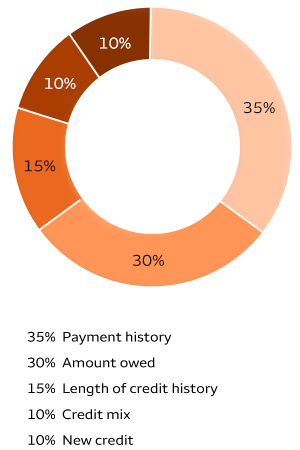

The length of your credit history is a key factor in determining your credit score. In fact, it accounts for fifteen percent of your FICO(r) score. This is because lenders are more likely you to be creditworthy the longer your credit history. When calculating the length of your credit history, there are a few things you should remember.

First, if you close an account, it will remain on your credit history for seven years. Although this might be shorter than you think, late payments will remain on your credit history for seven years. Closed accounts that still have an outstanding balance in them will be visible on your credit score until it is paid off. High balance accounts can be difficult to close.

Negative marks on credit reports are retained for seven years

There are several options to remove negative information from your credit reports. Although you can dispute any negative information with credit bureaus, it might take some time. Negative information will typically remain on your credit reports for seven to ten year. Some negative information may remain on your credit report longer than that.

Although the credit bureaus don't have to delete negative information, you can request them to. You can ask the bureaus to remove closed accounts if you have maintained good payment records for a while. In most cases, closed accounts age off of your credit report over a period of time. If there are any adverse information regarding closed accounts, they can be kept on your credit report up to seven years.