Credit cards are a great way to boost your credit score and you don't need a high score to get approved for a loan. However, you shouldn't use credit cards to make large purchases. Avoid paying high fees and close up cards that you don't use anymore. You should also avoid applying for large loans until your credit card debt is paid. This may seem complicated but it's actually very easy.

Not paying your bills automatically builds credit

Paying your bills in time is not the best method to build credit. Credit scores can be calculated from data reported to credit agencies, not the actual amount. This means you won't be able to build credit simply by paying your cable bills or joining a gym. Certain recurring charges, like telephone bills and insurance premiums can actually hurt your credit score.

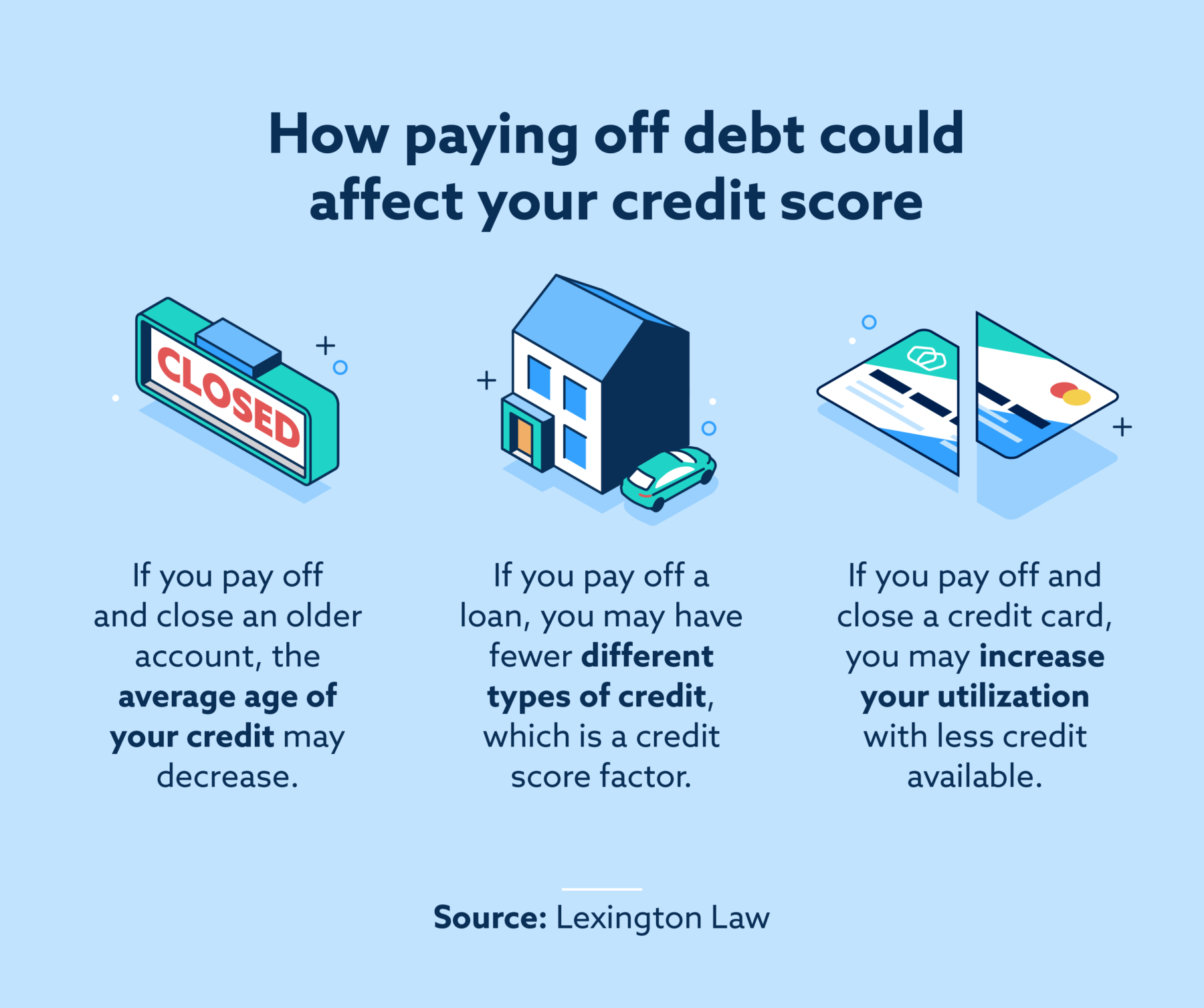

It is best to not charge more money than you have in your account. This will prevent excessive credit utilization. While you may feel like you can pay it later, the problem with overspending is that you won't be able to cover the charge if you lose your job or encounter an emergency. Credit card debt is something nobody wants, but it creeps up over you slowly.

Unsecured credit cards

You can improve your credit score by applying for an unsecured creditcard. But, it is important to ensure you can responsibly use your card. Many unsecured cards will only be available to consumers with good to excellent credit scores. It is important that you remember that credit card companies consider more than just your credit score. If you have a steady income and a clean credit report, you're more likely to be approved.

Another way to build credit is with secured credit cards. Secured credit cards require you to put up a deposit, which often becomes your credit limit. These cards also have lower credit limits than unsecured cards. You can often get your deposit back earlier if you spend responsibly. You can also use secured cards to buy online or at-store items.

Getting an authorized user on someone else's account

If you are looking to improve your credit score, it is possible to become an authorized user for someone's credit cards. Authorized users can help build positive credit habits like on-time payments and low debt compared to available credit. If you're not careful with your spending you may want to close the account.

Although adding an authorized user to an account can improve your credit score, it is not always a good idea. Authorized users need to have the trust of the account holder. This will allow them to improve their credit score without causing harm to the original account holder.

Reporting good behavior helps build credit

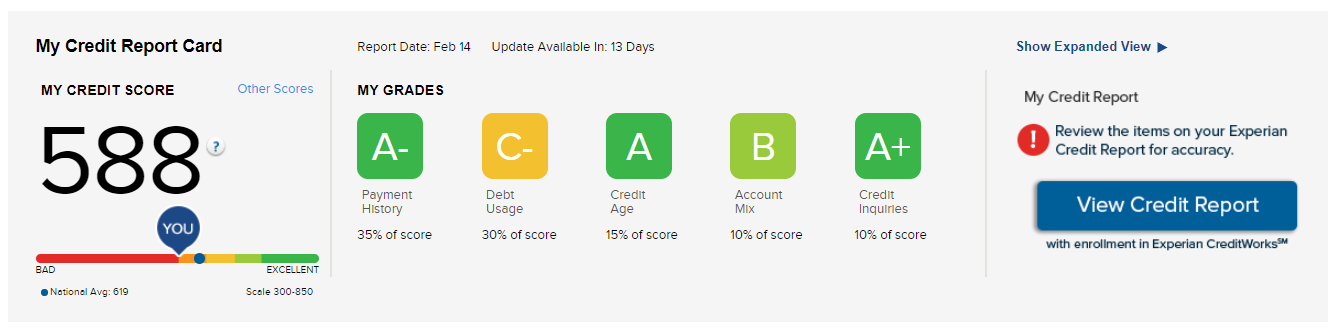

Credit score improvement can be achieved by reporting good behavior on a credit-card account. Your credit score is based upon the credit available to you. Avoid maxing out your credit cards. Paying off balances can reduce your credit utilization. You can also reduce your overall credit utilization by paying off your balances. This is good news for your credit score. Your goal should be to keep your utilization rate at 1%.