A credit card is a great option for helping children build a credit history. The process is simple. The company will send the card to your child if you add them as an authorized user online. A credit card for children is a great option because it is increasingly popular to use credit cards. T.RowePrice conducted a study and found that 17% of parents had a card for their children ages 8-14.

Greenlight

Greenlight is the perfect credit card for parents who are looking for a card to give their kids credit. The Greenlight credit card has zero card purchase fees and no ATM fees. There are also zero foreign transaction fees. It also offers features like contactless payments and allowance tracking, along with a low monthly service fee of $4.99. The card helps children learn financial responsibility by linking chores to rewards or allowances. Children can use it to check chores off and get instant notifications when they are complete.

Parents can load money on their child's Greenlight card manually, or they can set up recurring transfers. In this manner, weekly allowances will automatically be loaded to the card. Parents can also set-up parent-paid interest to their child's accounts.

GoHenry

The GoHenry credit card for kids is designed with financial education in mind. Its features include a customizable debit card and an app that lets kids set savings goals and manage their spending. The app lets parents monitor their child’s spending, and it is insured by the FDIC. Parents can also see their child's spending history, and track spending trends in realtime.

The GoHenry debit cards for kids and Greenlight credit cards for teens are both designed to teach financial responsibility. The app offers a number of tools to help kids manage their finances, such as colorful budgeting tools and chore trackers that add money on the card for household chores. This app gives parents the opportunity to monitor their children's spending habits and encourage financial responsibility.

Apple card for iPhone

Apple's credit card for children is a great way for children to learn about credit. This card comes with a range of features such as spending limits and the ability set up a budget. This card is also educational, so children can share it with an older sibling.

Parents can also set spending limits and create a family sharing group to track spending. Parents can invite five people to share their credit card and build it together. Each user must at least be 13 years old, and they must agree to take responsibility for their spending. Each owner is responsible for payment and the activity is shared to the credit bureaus.

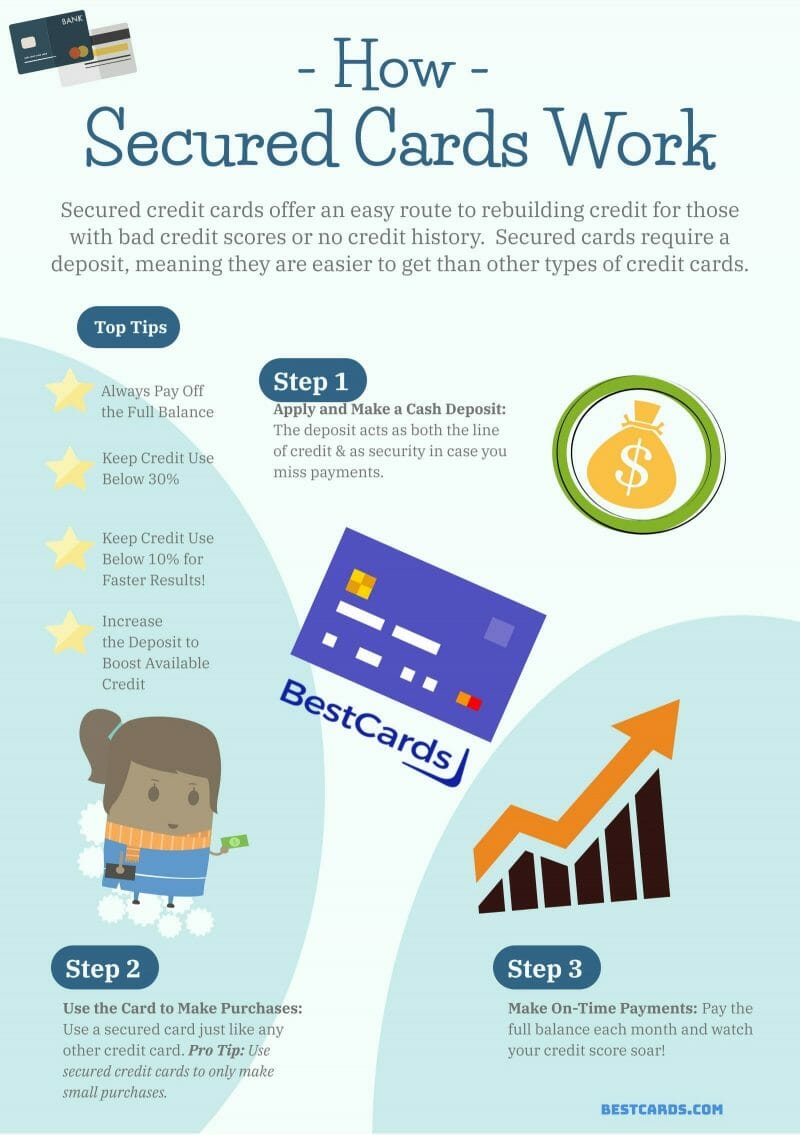

Secured credit cards

Secured credit cards are a good way for kids to build credit. However, there are a few things you should keep in mind before giving one to your child. First, secured cards are expensive and can carry high interest rates. You'll also have to pay an additional fee for transactions exceeding the limit. A secured card has one disadvantage: it is difficult to transfer balances between cards. A card that allows spending limits to be set and can be changed at will is a better choice. The last thing you want is for your child to have a card with a high limit, then find that he or she cannot pay it back.

Secured credit card for kids can teach your child about money management and how to avoid exceedingly high limits. They can be used to teach your child about credit limits, and help you build credit history. It is a good idea that they start young to help avoid major credit card mistakes later.