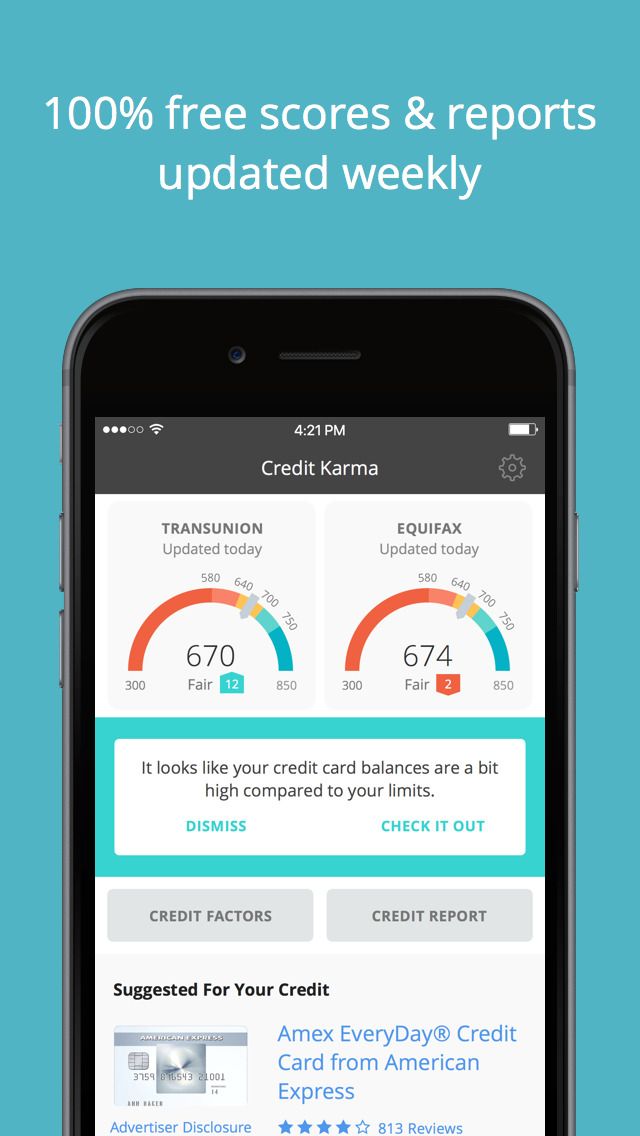

A high credit score is important for obtaining competitive reward cards. The American Express Gold Card, for example, requires a score of 670 or higher. The new model is expected impact 110 million customers. This is great news, especially for those who want to enjoy the best rewards cards. However, some of these cards are hard to get if you don't have a good score.

Length of credit history

Credit score calculations are influenced by the length of credit history. One or two open accounts can be fine. But, a longer credit history will help raise your score. Lenders use your credit history to predict your future behavior. If you have a recent pattern of late payments, a short credit history will not help your cause.

Your credit age represents the average age for all of your accounts. You'll want to raise your average credit age from seven years if you have three cards: Card One is three years, Card Two is five and Card Three is one.

Frequency for new credit

Lender to lender, the frequency of credit score updates can vary. Generally, lenders report new information to the three major CRAs once every 45 days, although some report more frequently. Your financial activity over time will affect how often your credit score is updated. After making a purchase with your debit card, your account balance may not reflect the actual transaction. Because major credit reporting agencies take 30 days to process transactions, this is why it may take up to 30 days before your transaction gets updated.

Three factors affect your credit score: payment history and credit history length. Your payment history makes up about 35 percent. Your length of credit history makes up 15 percent. Other factors affect your score include the types of credit you've used and the frequency of new credit inquiries.

Different types of credit

Understanding the various types of credit you have had is important when applying for credit. Lenders want to see that you are able to manage different types of credit. A person who only uses credit cards to pay their bills will have a lower credit score than someone who uses credit cards for other purposes. Your credit score is a key factor in many aspects, such as whether you can rent an apartment and whether your auto insurance rates are lower.

Lenders will use credit scores to assess your credit risk. They'll evaluate your credit worthiness based on five factors, including your credit mix. Each of these factors have different implications for your credit score.

Payment history

Credit score is affected by your payment history. This helps lenders to make lending decisions by analysing your history of timely payment. Collection accounts and missed payments can cause credit scores to be affected. You can avoid falling into this trap by paying all of your bills on time.

Credit bureaus will often be notified of your monthly payments by creditors. It is important that you keep your monthly payments on schedule so they show up on credit reports. Even on the rare occasion that you miss a payment, these payments will be reported as late.

Credit score will not be affected by medical bills that haven't been paid

While the U.S. has a large amount of medical credit, it is not reported to all creditors. A portion of the medical debt that will be reported to credit agencies in the summer 2022 will be removed. Most of the debt is due solely to an emergency situation. It does not reflect a person’s creditworthiness.

Credit bureaus won't include unpaid medical bills on consumer credit reports until July 1, 2022. This extra time will assist consumers in paying their medical bills and negotiating payments with their healthcare providers. In addition, paid medical debt will no longer appear on a consumer's credit report for up to seven years if it was reported prior to this policy change.